Contents

If you want to start a business in Spain, one of the questions before registering a company will be the choice of the type of business activity. There are two main types of companies in Spain: Sociedad Limitada (SL) and Sociedad Anónima (SA). These are the usual Ltd. and S.A., as we know them.

In this article we'll look at both forms of business, consider their pros and cons, the key differences to understand which is right for you.

What's the difference

Sociedad Limitada is a private limited company that can engage in any type of commercial or industrial activity. A separate situation is with the financial sector: in this case, a prior administrative authorization is required.

Sociedad Anónima is a corporate form mainly intended for large corporations.

The main differences

Responsibilities

Under Sociedad Limitada, each partner's liability is limited only to the money they have invested in the business. So if you do not want to take much risk and protect your personal assets, the SL is the ideal option for you.

In Sociedad Anónima, the partners' liability is also limited to the amount of money they have invested. However, they may also be liable for any unpaid debts if the business experiences financial difficulties.

Shareholders

The maximum number of shareholders of Sociedad Limitada is 50.

Sociedad Anónima may have as many shareholders as it wishes.

Equity

According to the innovations of the law on business registration in Spain, it is possible to create companies without a physical investment of capital, but under the personal responsibility of the founders. This makes it more accessible to entrepreneurs and small firms.

Sociedad Anónima must have a capital of 60,000 euros, at least 25% of which must be subscribed and paid for at the time of registration.

Taxes

Corporate tax in Spain is 25%. This tax applies to both (SL) and (SA). Special rates can range from 15% (startups, research on R&D) to 30% (banks).

Also, do not forget about the additional tax of 19% for companies whose office is registered outside of Spain.

Managing

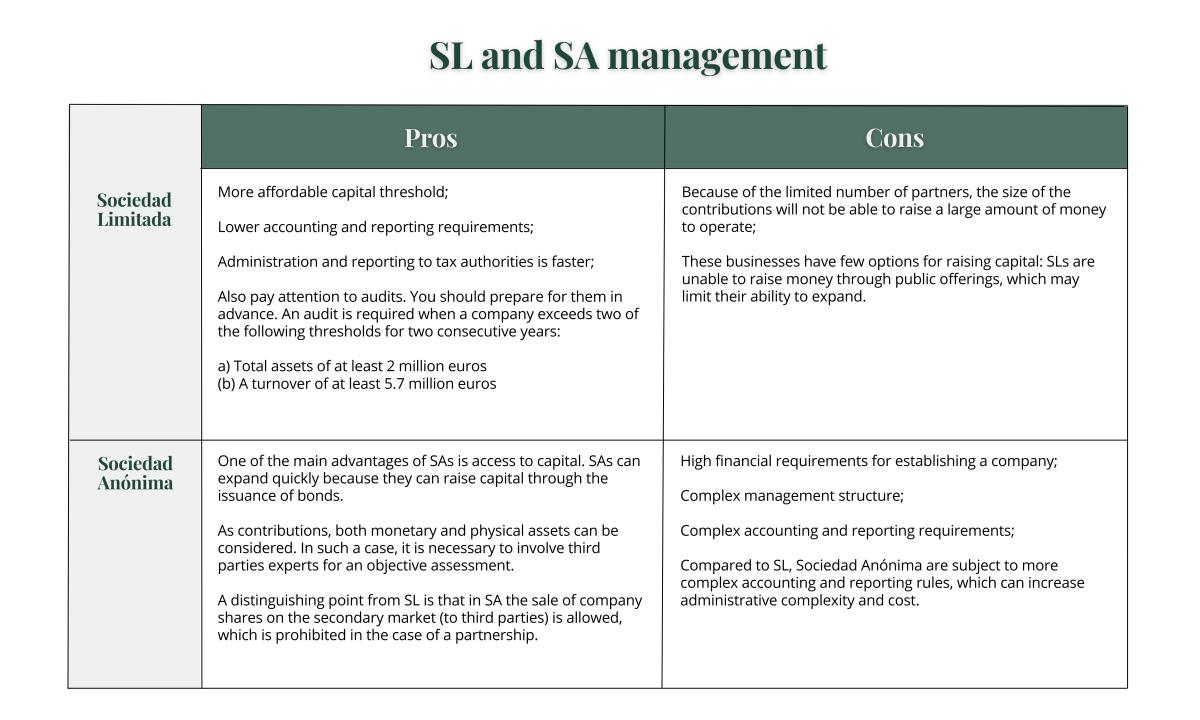

One or more participants, who may or may not be members of the business, are responsible for the management of Sociedad Limitada (SL). This form of economic activity is also distinguished by its flexible management structure.

Compared to SA, the SL management structure is more "down-to-earth," allowing partners to choose how to assign tasks and responsibilities.

Sociedad Anónima (SA) is managed by a board of directors elected by the shareholders.

In short, Sociedad Limitada (SL) may be the preferred choice if you intend to start a small firm with a small group of partners and have limited financial resources.

On the other hand Sociedad Anónima. This option is suitable if you want to raise a significant amount of money through public offerings or have a large number of shareholders.

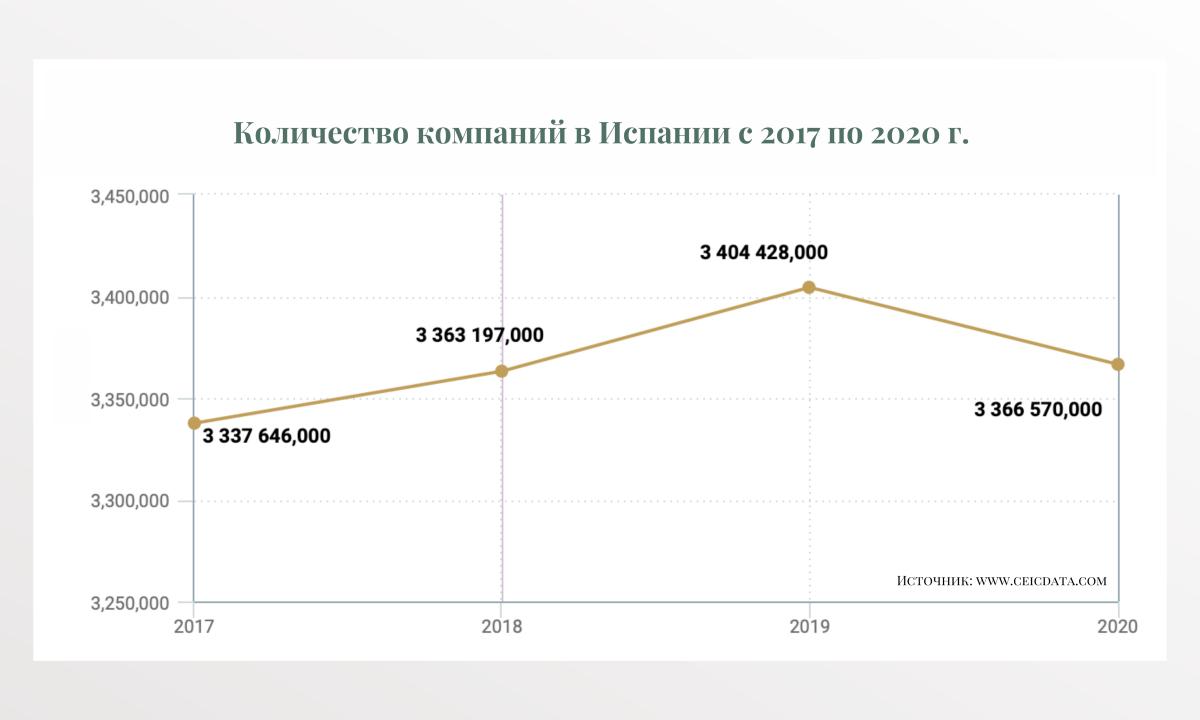

The graph of existing companies shows that there are fewer businesses after 2019. Due to COVID 19, many businesses have closed. In terms of the form of business activities, it is obvious that joint stock companies were able to hold on to most of them thanks to loans and issued liabilities. At this time, limited liability companies could not withstand the losses.

Therefore, it can be argued that in a crisis it is more profitable to be a partner of Sociedad Anónima than Sociedad Limitada.

Based on how many partners or shareholders you intend to have, the amount of capital you can contribute, and your personal management and liability preferences will determine which choice is ideal for you.

If you still have questions about choosing the type of company, try to enlist the help of professionals. A professional consulting agency will be able to tell you how best to register a company, what benefits and obligations each type imposes, and which option is right for your type of activity.

Please note that all materials contained on this site have been prepared for informational purposes only. This data does not constitute or replace professional financial, legal or tax advice. The information is general in nature and does not take into account your personal circumstances. Always seek professional advice from officially licensed professionals: financial advisors, accountants and lawyers.