Contents

- Advantages of opening an IT-company in Spain

- How to start a company in Spain

- State support and tax incentives

- Conclusion

Recent innovations in startup laws, the attraction of digital nomads, additional tax incentives and simplifications in the company registration process make Spain attractive for starting your own business in the IT field.

In this article we will describe the registration procedure of an IT-company, tell you about the nuances and pitfalls, as well as analyze the taxation system and tax preferences that await future IT-start-ups.

Advantages of opening an IT-company in Spain

Favourable environment

Spain has a dynamic startup environment with government programs and private sector support.

- Spain Startup & Investor Summit

Entrepreneurs, investors from around the world gather at the annual Startup & Investor Summit in Spain to network and learn about the prospects of Spain's startup ecosystem. - Enisa

This government organization provides funding and assistance to innovative businesses in Spain, especially IT companies. They offer various financial solutions, including loans, to expand the ambitions of a growing company. - Red.es

The company works to promote the digital transformation of the Spanish economy. They provide preferential programs to IT companies with additional support from European Development Funds. - Softlanding

Startup acceleration program with a base in Spain. Softlanding supports the creation of foreign firms in Spain and gives them access to financial, educational and other resources.

Access to the European market

With easy access to the rest of Europe and a significant market of potential customers, Spain's strategic location within the EU makes it an attractive location for international trade.

How to start a company in Spain

The procedure for opening an IT-company in Spain is the same as the registration of other firms. Let's go over each of the points briefly:

- Choose the type of company. You can read more about this in the article about company forms.

- Register the name of the company in the Commercial Registry.

- Open a bank account and pay the minimum capital. The new version of the company registration law now allows for the option of not having to pay capital physically, but under the personal responsibility of the founders.

- Registration of the company charter. This can be done through a service point for entrepreneurs (PAE), but in that case you will not be able to fulfill or change the articles of association. The alternative is the services of a notary. This is more expensive and takes more time, but you can prepare a charter that fully meets your needs.

- Obtaining a CIF - fiscal identification number. Any commercial transaction, including the payment of taxes, must be done using a fiscal identification number.

If the founders are non-resident legal entities or individuals, they are required to apply for a NIF. To do this, they must fill out and submit a form to the police to obtain a non-resident tax number (applies to individuals). For legal entities, it is already the opening of a representative office or branch. - Registering the company with the tax authorities.

If you have not undergone the company registration procedure before, you can use the services of specialists — they will accompany you at each stage, help you gather the necessary documents and reduce the entire process as much as possible.

The amount needed to open a business can vary greatly. It depends on the type of business, the niche, and other factors. However, some IT business models may require less start-up money than others.

Launching a cybersecurity or SaaS company will require large financial investments. After all, at first, a significant portion of finances will be spent on servers, storage, databases, networks, software, analytics and business intelligence.

The most affordable option is to start up software companies or an IT consulting firm. They often just need a computer and some software tools for web design and development.

State support and tax incentives

The Spanish government provides a number of tax breaks and incentives for start-ups, especially in the IT industry, which can make setting up a firm in Spain more attractive.

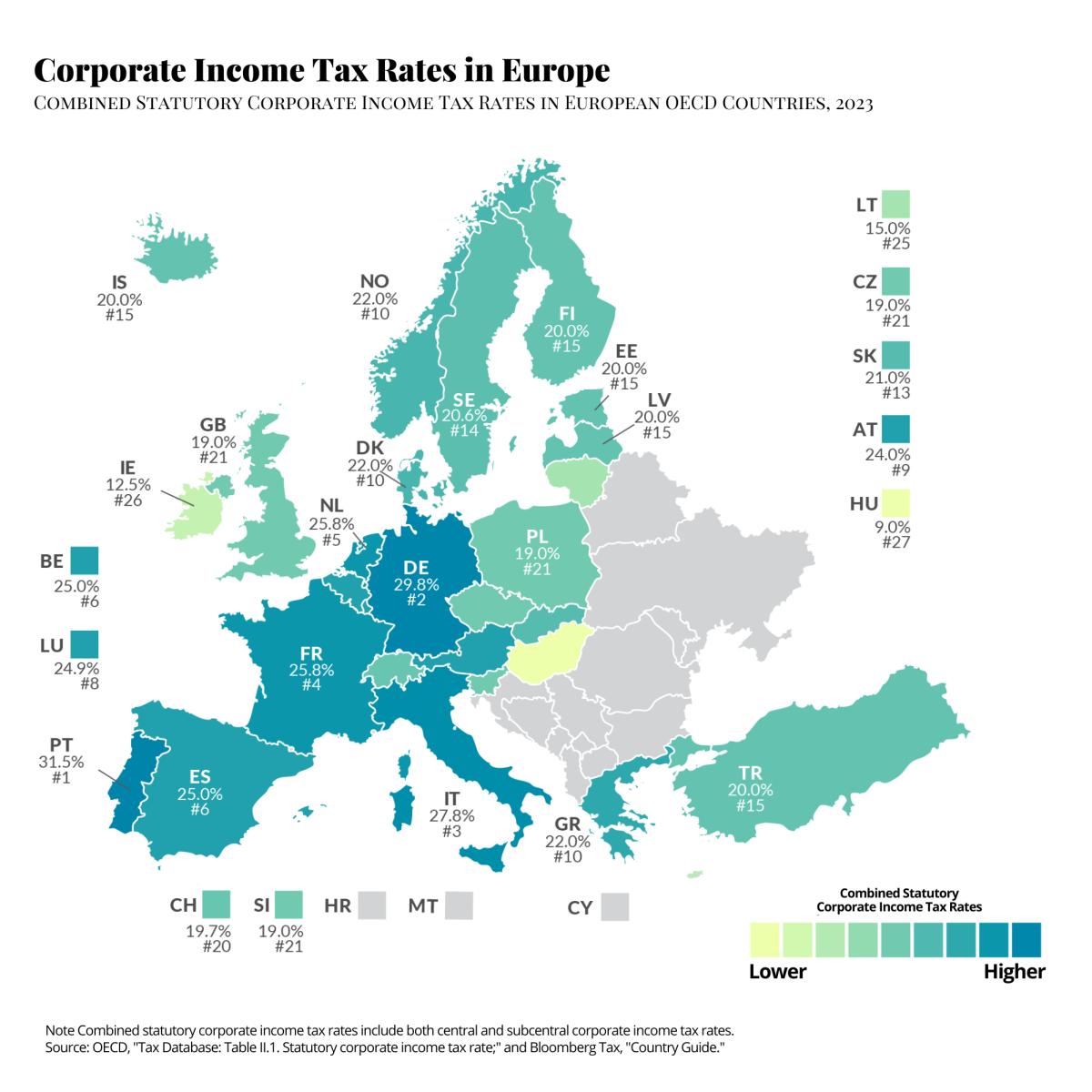

Low corporate tax. Spain can distinguish itself for the low income tax rate for companies in Western Europe - 25%, which can be reduced to 15%. For new businesses and those based in certain areas of the country, additional discounts are offered.

For example, businesses located in the Canary Islands fall into a "special economic zone," a tool that offers tax incentives to stimulate the Canary Islands' economy.

So, some of the benefits are:

- Corporate tax rate of 4%

- Income tax exemption for non-residents, subject to conditions

- Exemption from transfer of ownership and purchase of property for the company

- Exemption from tax on corporate transactions, except for liquidation

- Exemption from tax on documented legal acts related to operations conducted in the geographical area of the «special economic zone»

We talk about other opportunities to reduce business taxes in a separate article.

Tax incentives for companies with innovation potential. If a company conducts scientific, technical or design developments, it can be considered "innovative. Often these are companies working in IT, manufacturing, or developing their own technology.

For such companies, there are incentives in Spain, including tax breaks of up to 25% of the cost of investment in innovative technology. So if you can make a profit in IT and try to contribute to the development of new technologies, this benefit will help you cut costs.

Deductions for initial costs. Newly registered businesses in Spain are entitled to tax relief on their initial costs: administrative and legal fees, the cost of registering patents and trademarks.

Employment tax credits. Employers are also entitled to various employment tax benefits, including lower social security contributions for new hires and for businesses that hire disabled workers. The practice of hiring young employees between the ages of 16 and 30 is also popular. Such firms are entitled to a three-year reduction in their social security contributions.

Conclusion

Spain has a favorable environment for business and IT companies, in particular tax incentives and programs from the government. However, before proceeding to action, you should carefully study the tax legislation of the region of Spain where you want to register a company and think through a business plan to get the benefits.

If you are starting a company in Spain for the first time, you may encounter some difficulties. Including a lack of understanding of the local legislation, its formal and legal aspects. When opening a company in Spain on your own, without the appropriate experience, the process can take several months. To go through the whole procedure in a short time and without unnecessary delays, contact the professionals: they will help you with the registration of the company, banking services and registration in all registries.

Please note that all materials contained on this site have been prepared for informational purposes only. This data does not constitute or replace professional financial, legal or tax advice. The information is general in nature and does not take into account your personal circumstances. Always seek professional advice from officially licensed professionals: financial advisors, accountants and lawyers.